题目

From a different supplier, Nesud Co purchases $2·4 million per year of Component K at a price of $5 per component. Consumption of Component K can be assumed to be at a constant rate throughout the year. The company orders components at the start of each month in order to meet demand and the cost of placing each order is $248·44. The holding cost for Component K is $1·06 per unit per year.

The finance director of Nesud Co is concerned that approximately 1% of credit sales turn into irrecoverable debts. In addition, she has been advised that customers of the company take an average of 65 days to settle their accounts, even though Nesud Co requires settlement within 40 days.

Nesud Co finances working capital from an overdraft costing 4% per year. Assume there are 360 days in a year.

Required:

(a) Evaluate whether Nesud Co should accept the early settlement discount offered by its supplier. (4 marks)

(b) Evaluate whether Nesud Co should adopt an economic order quantity approach to ordering Component K. (6 marks)

(c) Critically discuss how Nesud Co could improve the management of its trade receivables. (10 marks)

更多“Nesud Co has credit sales of $45 million per year and on average settles accounts with tra”相关的问题

更多“Nesud Co has credit sales of $45 million per year and on average settles accounts with tra”相关的问题

第1题

Credit customers of ZXC Co take an average of 51 days to settle invoices. Approximately 0·5% of the company’s credit sales have historically become bad debts each year and written off as irrecoverable. The finance director has been advised that offering an early settlement discount of 0·5% for payment within 30 days would increase administration costs by $35,000 per year, while 75% of credit customers would be likely to take the discount. The credit controller believes that bad debts would fall to 0·375% of credit sales if the early settlement discount were introduced.

ZXC Co has an average short-term cost of finance of 4% per year. Assume that there are 360 days in each year.

Required:

(a) Evaluate whether ZXC Co should introduce the early settlement discount. (6 marks)

(b) Discuss TWO ways in which a company could reduce the risk associated with foreign accounts receivable. (4 marks)

第2题

Oscar Co designs and produces tracking devices. The company is managed by its four founders, who lack business administration skills. The company has revenue of $28m, and all sales are on 30 days’ credit. Its major customers are large multinational car manufacturing companies and are often late in paying their invoices. Oscar Co is a rapidly growing company and revenue has doubled in the last four years. Oscar Co has focused in this time on product development and customer service, and managing trade receivables has been neglected. Oscar Co’s average trade receivables are currently $5.37m, and bad debts are 2% of credit sales revenue. Partly as a result of poor credit control, the company has suffered a shortage of cash and has recently reached its overdraft limit. The four founders have spent large amounts of time chasing customers for payment. In an attempt to improve trade receivables management, Oscar Co has approached a factoring company. The factoring company has offered two possible options: Option 1 Administration by the factor of Oscar Co’s invoicing, sales accounting and receivables collection, on a full recourse basis. The factor would charge a service fee of 0·5% of credit sales revenue per year. Oscar Co estimates that this would result in savings of $30,000 per year in administration costs. Under this arrangement, the average trade receivables collection period would be 30 days. Option 2 Administration by the factor of Oscar Co’s invoicing, sales accounting and receivables collection on a non-recourse basis. The factor would charge a service fee of 1·5% of credit sales revenue per year. Administration cost savings and average trade receivables collection period would be as Option 1. Oscar Co would be required to accept an advance of 80% of credit sales when invoices are raised at an interest rate of 9% per year. Oscar Co pays interest on its overdraft at a rate of 7% per year and the company operates for 365 days per year. (a) Calculate the costs and benefits of each of Option 1 and Option 2 and comment on your findings. (b) Discuss reasons (other than costs and benefits already calculated) why Oscar Co may benefit from the services offered by the factoring company.

第3题

What is the net investment in working capital required for the next year?

A.$8,125,000

B.$4,375,000

C.$2,875,000

D.$6,375,000

第4题

Parket Co made a mark-up on cost of 25% on all sales to Suket Co.

What is Parket Co’s consolidated cost of sales for the year ended 31 March 20X7?

A.$954,000

B.$950,000

C.$774,000

D.$766,000

第5题

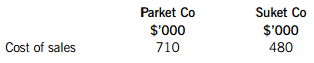

Parket Co acquired 60% of Suket Co on 1 January 20X7. The following extract has been taken from the individual statements of profit or loss for the year ended 31 March 20X7: Parket Co Suket Co $'000 $'000 Cost of sales 710 480 Parket Co consistently made sales of $20,000 per month to Suket Co throughout the year. At the year end, Suket Co held $20,000 of this in inventory. Parket Co made a mark-up on cost of 25% on all sales to Suket Co. Using the drop down box select the correct figure for Parket Co's consolidated cost of sales for the year ended 31 March 20X7?

A、$954,000

B、$950,000

C、$774,000

D、$766,000

第6题

Premier Co acquired 80% of Sanford Co on 1 June 20X1. Sales from Sanford Co to Premier Co throughout the year ended 30 September 20X1 were consistently $1 million per month. Sanford Co made a mark-up on cost of 25% on these sales. At 30 September 20X1 Premier Co was holding $2 million inventory that had been supplied by Sanford Co in the post-acquisition period.By how much will the unrealised profit decrease the profit attributable to the non-controlling interest for the year ended 30 September 20X1?

A、$80,000

B、$82,000

C、$70,000

D、$72,000

第7题

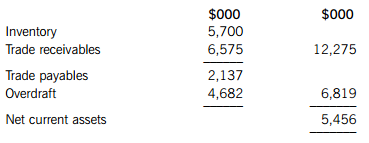

For the year to end of March 2014, CSZ Co had domestic and foreign sales of $40 million, all on credit, while cost of sales was $26 million. Trade payables related to both domestic and foreign suppliers.

For the year to end of March 2015, CSZ Co has forecast that credit sales will remain at $40 million while cost of sales will fall to 60% of sales. The company expects current assets to consist of inventory and trade receivables, and current liabilities to consist of trade payables and the company’s overdraft.

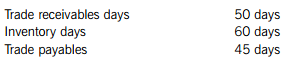

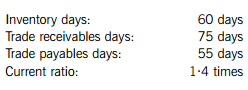

CSZ Co also plans to achieve the following target working capital ratio values for the year to the end of March 2015:

Required:

(a) Calculate the working capital cycle (cash collection cycle) of CSZ Co at the end of March 2014 and discuss whether a working capital cycle should be positive or negative. (6 marks)

(b) Calculate the target quick ratio (acid test ratio) and the target ratio of sales to net working capital of CSZ Co at the end of March 2015. (5 marks)

(c) Analyse and compare the current asset and current liability positions for March 2014 and March 2015, and discuss how the working capital financing policy of CSZ Co would have changed. (8 marks)

(d) Briefly discuss THREE internal methods which could be used by CSZ Co to manage foreign currency transaction risk arising from its continuing business activities. (6 marks)

第8题

KXP Co is an e-business which trades solely over the internet. In the last year the company had sales of $15 million. All sales were on 30 days’ credit to commercial customers.

Extracts from the company’s most recent statement of financial position relating to working capital are as follows:

In order to encourage customers to pay on time, KXP Co proposes introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 50% of customers will take the discount and pay within 30 days, 30% of customers will pay after 45 days, and 20% of customers will not change their current paying behaviour.

KXP Co currently orders 15,000 units per month of Product Z, demand for which is constant. There is only one supplier of Product Z and the cost of Product Z purchases over the last year was $540,000. The supplier has offered a 2% discount for orders of Product Z of 30,000 units or more. Each order costs KXP Co $150 to place and the holding cost is 24 cents per unit per year.

KXP Co has an overdraft facility charging interest of 6% per year.

Required:

(a) Calculate the net benefit or cost of the proposed changes in trade receivables policy and comment on your findings. (6 marks)

(b) Calculate whether the bulk purchase discount offered by the supplier is financially acceptable and comment on the assumptions made by your calculation. (6 marks)

(c) Identify and discuss the factors to be considered in determining the optimum level of cash to be held by a company. (5 marks)

(d) Discuss the factors to be considered in formulating a trade receivables management policy. (8 marks)

第9题

Tree Co is considering employing a sales manager. Market research has shown that a good sales manager can increase profit by 30%, an average one by 20% and a poor one by 10%. Experience has shown that the company has attracted a good sales manager 35% of the time, an average one 45% of the time and a poor one 20% of the time. The company’s normal profits are $180,000 per annum and the sales manager’s salary would be $40,000 per annum.

Based on the expected value criterion, which of the following represents the correct advice which Tree Co should be given?

A.Do not employ a sales manager as profits would be expected to fall by $1,300

B.Employ a sales manager as profits will increase by $38,700

C.Employ a sales manager as profits are expected to increase by $100

D.Do not employ a sales manager as profits are expected to fall by $39,900

第10题

A、Blonnick has relaxed its credit standards this year.

B、Blonnicks credit customers are paying more slowly this year.

C、Credit sales are a greater part of Blonnicks business this year.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!