题目

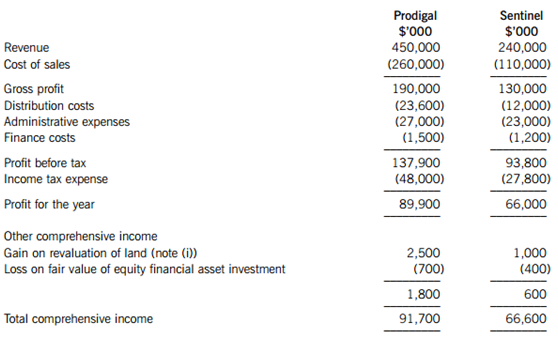

The summarised statements of comprehensive income for the two companies for the year ended 31 March 2011 are:

The following information for the equity of the companies at 1 April 2010 (i.e. before the share exchange took place) is available:

The following information is relevant:

(i) Prodigal’s policy is to revalue the group’s land to market value at the end of each accounting period. Prior to its acquisition Sentinel’s land had been valued at historical cost. During the post acquisition period Sentinel’s land had increased in value over its value at the date of acquisition by $1 million. Sentinel has recognised the revaluation within its own financial statements.

(ii) Immediately after the acquisition of Sentinel on 1 October 2010, Prodigal transferred an item of plant with a carrying amount of $4 million to Sentinel at an agreed value of $5 million. At this date the plant had a remaining life of two and half years. Prodigal had included the profit on this transfer as a reduction in its depreciation costs. All depreciation is charged to cost of sales.

(iii) After the acquisition Sentinel sold goods to Prodigal for $40 million. These goods had cost Sentinel $30 million. $12 million of the goods sold remained in Prodigal’s closing inventory.

(iv) Prodigal’s policy is to value the non-controlling interest of Sentinel at the date of acquisition at its fair value which the directors determined to be $100 million.

(v) The goodwill of Sentinel has not suffered any impairment.

(vi) All items in the above statements of comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Prepare the consolidated statement of comprehensive income of Prodigal for the year ended 31 March 2011;

(ii) Prepare the equity section (including the non-controlling interest) of the consolidated statement of financial position of Prodigal as at 31 March 2011.

Note: you are NOT required to calculate consolidated goodwill or produce the statement of changes in equity.

The following mark allocation is provided as guidance for this requirement:

(i) 14 marks

(ii) 7 marks (21 marks)

(b) IFRS 3 Business combinations permits a non-controlling interest at the date of acquisition to be valued by one of two methods:

(i) at its proportionate share of the subsidiary’s identifiable net assets; or

(ii) at its fair value (usually determined by the directors of the parent company).

Required:

Explain the difference that the accounting treatment of these alternative methods could have on the consolidated financial statements, including where consolidated goodwill may be impaired. (4 marks)

更多“On 1 October 2010 Prodigal purchased 75% of the equity shares in Sentinel. The acquisition”相关的问题

更多“On 1 October 2010 Prodigal purchased 75% of the equity shares in Sentinel. The acquisition”相关的问题

第1题

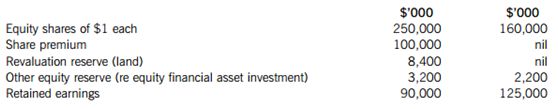

The following trial balance relates to Cavern as at 30 September 2010:

The following notes are relevant:

(i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance.

(ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective fi nance cost of 10% per annum.

(iii) Non-current assets:

Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the fi nancial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales.

(iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010.

(v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%.

Required:

(a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.

(b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010.

(c) Prepare the statement of fi nancial position of Cavern as at 30 September 2010.

Notes to the fi nancial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 5 marks

(c) 9 marks

第2题

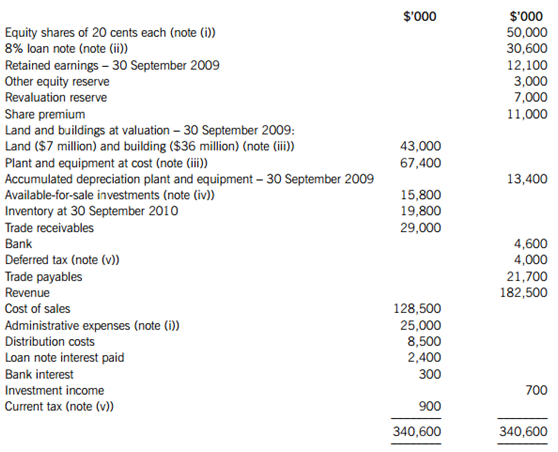

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

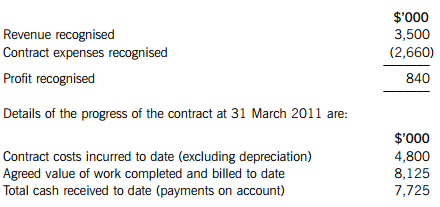

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

第3题

n 1953 the Conservative Government introduced a bill to()commercial television. This was opposed very strongly by the()Parties, but the bill was passed and commercial television flourishes. Now there is a collection of()services over a variety of distribution media, through which there are over 480 channels for consumers as well as(). In the United Kingdom and(), any household watching or recording live television transmissions as they are being broadcast (terrestrial, satellite, cable, or Internet) is required to hold a(). Since April 1, 2010 the()has been £145.50 for color and £49.00 for(). On October 24, 2012, all television broadcasts in the United Kingdom were in a digital format.

第4题

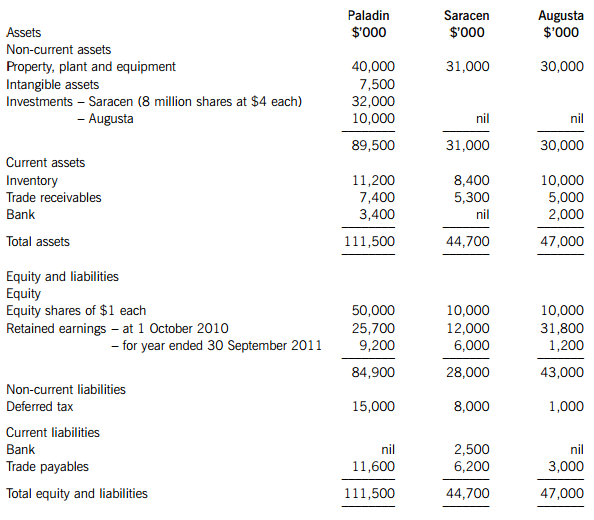

an immediate payment of $4 per share on 1 October 2010; and

a further amount deferred until 1 October 2011 of $5·4 million.

The immediate payment has been recorded in Paladin’s financial statements, but the deferred payment has not been recorded. Paladin’s cost of capital is 8% per annum.

On 1 February 2011, Paladin also acquired 25% of the equity shares of Augusta paying $10 million in cash. The summarised statements of financial position of the three companies at 30 September 2011 are:

The following information is relevant:

(i) Paladin’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose the directors of Paladin considered a share price for Saracen of $3·50 per share to be appropriate.

(ii) At the date of acquisition, the fair values of Saracen’s property, plant and equipment was equal to its carrying amount with the exception of Saracen’s plant which had a fair value of $4 million above its carrying amount. At that date the plant had a remaining life of four years. Saracen uses straight-line depreciation for plant assuming a nil residual value. Also at the date of acquisition, Paladin valued Saracen’s customer relationships as a customer base intangible asset at fair value of $3 million. Saracen has not accounted for this asset. Trading relationships with Saracen’s customers last on average for six years.

(iii) At 30 September 2011, Saracen’s inventory included goods bought from Paladin (at cost to Saracen) of $2·6 million. Paladin had marked up these goods by 30% on cost. Paladin’s agreed current account balance owed by Saracen at 30 September 2011 was $1·3 million.

(iv) Impairment tests were carried out on 30 September 2011 which concluded that consolidated goodwill was not impaired, but, due to disappointing earnings, the value of the investment in Augusta was impaired by $2·5 million.

(v) Assume all profits accrue evenly through the year.

Required:

Prepare the consolidated statement of financial position for Paladin as at 30 September 2011.

第5题

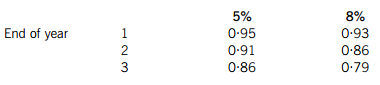

When preparing the draft financial statements for the year ended 30 September 2011, the directors are proposing to show the loan note within equity in the statement of financial position, as they believe all the loan note holders will choose the equity option when the loan note is due for redemption. They further intend to charge a finance cost of $500,000 ($10 million x 5%) in the income statement for each year up to the date of redemption.

The present value of $1 receivable at the end of each year, based on discount rates of 5% and 8%, can be taken as:

Required:

(a) (i) Explain why the nominal interest rate on the convertible loan notes is 5%, but for non-convertible loan notes it would be 8%. (2 marks)

(ii) Briefly comment on the impact of the directors’ proposed treatment of the loan notes on the financial statements and the acceptability of this treatment. (3 marks)

(b) Prepare extracts to show how the loan notes and the finance charge should be treated by Bertrand in its financial statements for the year ended 30 September 2011. (5 marks)

第6题

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

第7题

As requested _____ your E-mail of October 1, we are sending you _____ the required quotation sheet.

A. in, herewith

B. for, herewith

C. for, in

D. on, herewith

第8题

英译汉:The People's Republic of China (PRC), founded on October 1, 1949, covers an area of 9.6 million square kilometers.

第9题

A.October 31st

B.November 5th

C.March 1 7th

D.December 25th

第11题

(1)( ) 29th November 2008

(2)( ) 4th December 2008

(3)( ) 14th December 2008

(4)( ) 51h December 2008

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!